How can I avoid repossession?

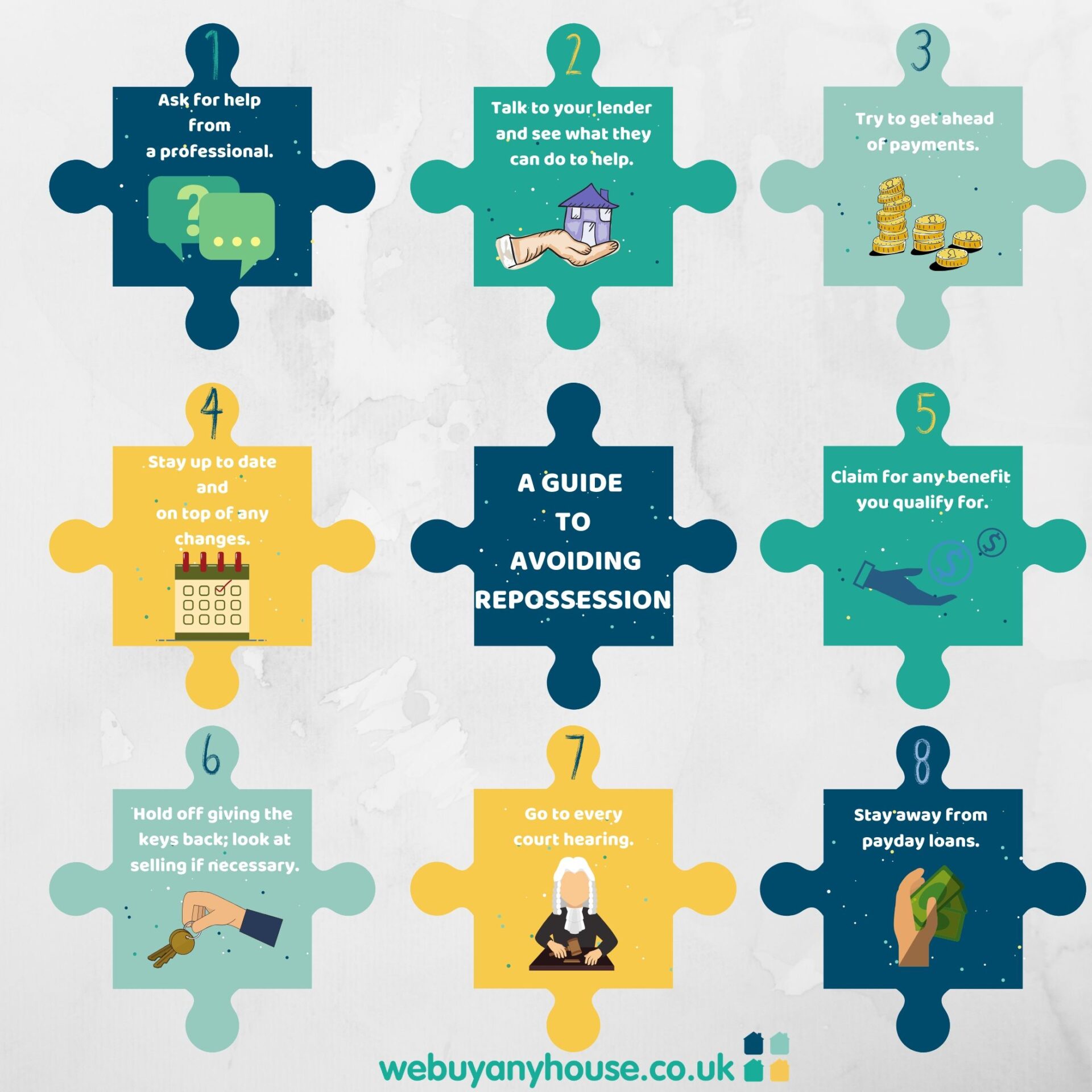

How can I avoid repossession? 1. Get professional help 2. Talk to your lender 3. Build up a buffer on your monthly payments 4. Stay up to date 5. Claim any benefits you qualify for 6. Don’t give your keys in 7. Go to every court hearing 8. Stay away from payday loans Facing repossession

How can I avoid repossession?

1. Get professional help

2. Talk to your lender

3. Build up a buffer on your monthly payments

4. Stay up to date

5. Claim any benefits you qualify for

6. Don’t give your keys in

7. Go to every court hearing

8. Stay away from payday loans

Facing repossession can be one of the hardest parts of being a homeowner, but it’s important to know that there are lots of ways that you can avoid repossession. We Buy Any House have put together a handy article to outline how you can save your house from being repossessed.

Get a cash offer for your house today!

1. Get professional help

Consider looking into a debt management plan if you’re not in a position to manage your finances efficiently yourself. There is no shame in asking for help, addressing the situation is a much better approach than ignoring it and hoping that it will blow over. Take control, the earlier you intervene the less damage that’s done.

2. Talk to your lender

As soon as you know that you’re going to have problems paying your mortgage, notify your lender and see if they can help. Often, they will see you coming to them as a responsible move and allow you to decrease your monthly payments or only pay interest for a few months as a goodwill gesture to give you time to get back on your feet. Until you ask you don’t know what help they could offer, so speaking to them and making them aware of your situation could ease the pressure you’re under massively.

3. Build up a buffer on your monthly payments

Most mortgages are flexible and will allow you to make extra payments when you’re in a position to do so. This is ideal if you know in advance that you’re going to face a tough month or few, so building up a buffer will protect you from arrears.

4. Stay up to date

Make sure that you know what is going on every step and if there are any changes, you need to be aware of them instantly. Keep in regular contact with your lender and open/respond to every letter they send.

5. Claim any benefits you qualify for

Check what your eligibility is and claim for anything that you can. Even if it isn’t much, it’s extra each month that could make all the difference for your repayments and keep you afloat.

6. Don’t give your keys in

If you give your property up your lender will sell it, most likely at auction as it’s the easiest option. Selling at auction usually means the property will go for a lower price than if it was sold on the market through an estate agent, meaning you could lose out as anything left after your debt is returned to you. If you’re in a position in which you can’t afford your monthly payments and think about selling your house is the best decision, visit We Buy Any House for a free offer and see what you could gain instead of giving your keys over and potentially getting less. Selling yourself also means you avoid the negative after-effects of repossession, as it can make getting another mortgage incredibly difficult.

7. Go to every court hearing

Missing these hearings could mean you miss important information, so go to every meeting and fight your corner. Keeping up to date will give you maximum time to deal with any decision and put you on good footing to dispute a decision if you feel it’s unfair.

8. Stay away from payday loans

Whilst it can be tempting to take out a loan to cover a debt, payday loans are a vicious cycle that can leave you in more debt than you started. Don’t get yourself into more debt long-term to try and solve the problem quickly.

There are plenty of ways that you can avoid repossession, even once the ball has started rolling. Staying on top of it is important, but trying not to panic is the main thing. As long as you’re sensible, you can deal with it efficiently.

We buy any home in as little as 7 days, or timescales to suit you. Head to our website for more information.