Future forecast: Will cash house buyers dominate the market?

Cash buyers have become one of the most powerful forces in the UK property market, fuelled by economic pressures, tighter lending rules and the rise of professional fast-sale companies.

The UK property market has undergone enormous change over the last decade, shifting from one primarily driven by mortgage-backed buyers to one where cash buyers have steadily gained greater influence.

While mortgage lending once shaped the pace, structure and security of most transactions, the balance has tipped dramatically as cash buyers have stepped into the spotlight.

The rise has been fuelled by economic pressures, increasingly complex lending criteria, demographic changes and the emergence of professional fast-sale companies capable of purchasing homes outright.

Between 2022 and 2024, interest rate volatility created one of the toughest lending environments the UK had seen in several years.

Many traditional buyers found themselves pushed out of the market by affordability checks, deposit requirements and high monthly repayments.

Meanwhile, cash buyers were able to proceed without these obstacles, and their ability to buy quickly made them highly attractive to sellers. As a result, cash buyers secured a greater share of UK transactions than ever before.

The growing power of cash buyers in the modern market

Cash buyers have become influential because they remove one of the greatest uncertainties of a property transaction: the reliance on a lender.

Mortgage lenders can:

- Delay valuations

- Refuse applications

- Reduce previously agreed lending amounts

- Withdraw offers altogether

During the years of rising interest rates, these issues became even more common. Many sellers who accepted offers from mortgage-backed buyers watched their sales fall through at late stages, sometimes multiple times. In contrast, cash buyers offered speed, stability and near total certainty.

This speed is important because it allows sellers to complete transactions in a matter of weeks rather than months.

For homeowners facing time-sensitive situations, such as relocation, divorce, probate, financial difficulty or the threat of repossession, cash buyers became the most reliable option available.

Companies like We Buy Any House have brought professionalism, transparency and dependability to a sector that previously lacked consistency.

We use our own funds to purchase properties directly from homeowners, offering immediate valuations and guaranteed sales within days rather than months.

Our ability to buy any property, regardless of condition or circumstance, has filled the gap for homeowners who need a secure and fast transaction.

This reliability has strengthened the reputation of cash buyers as a whole and has made the concept of selling to cash buyers more widely understood and accepted by the general public.

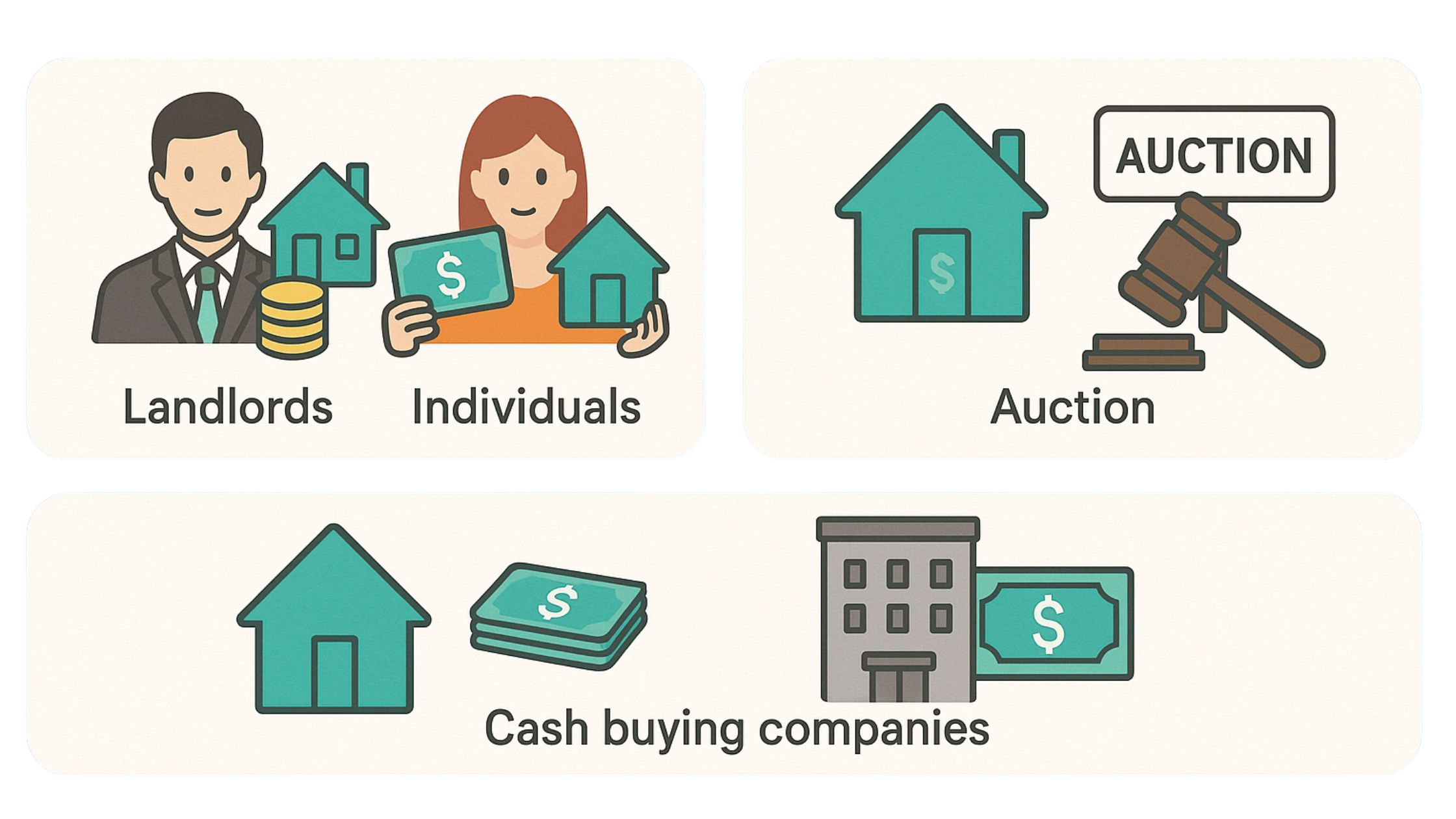

Understanding the different types of cash buyers

When discussing cash buyers, it is easy to imagine a single category, but the reality is far more complex. The UK property market includes several distinct groups of cash buyers, each playing a different role and influencing the market in various ways.

Individuals

The largest group of cash buyers consists of private individuals who have accumulated enough equity to purchase their next home without a mortgage.

This often happens when someone sells a high-value property and relocates to a more affordable region.

They may be downsizing, moving for lifestyle reasons or relocating to be closer to family. These buyers are usually chain free, decisive and willing to pay a fair market price, making them attractive to sellers.

Landlords

Another significant group comprises buy-to-let landlords who purchase rental properties outright. These individuals value the speed and simplicity that cash offers because it allows them to secure properties in competitive areas quickly.

Their ability to buy without waiting for lending approval means they can expand their portfolios with fewer obstacles, particularly when targeting homes that require refurbishment or properties in high-demand rental markets.

Auction

Auction buyers form another important group.

Auctions typically require completion within 28 days, a timeline that most mortgage backed buyers cannot meet. As a result, the majority of auction participants are cash purchasers.

Their presence ensures that properties with short timelines, legal complications or structural issues continue to attract strong interest, even when conventional lenders are unwilling to finance these homes.

Cash buying companies

Professional cash buying companies such as We Buy Any House form a rapidly growing segment of the market. We Buy Any House specialises in buying properties directly from homeowners using our own funds.

We provide immediate offers, cover legal fees and complete transactions extremely quickly. Our willingness to buy homes in any condition, including those with serious defects or legal complexities, has made us essential for sellers who need certainty or who wish to avoid the unpredictable nature of the open market.

Regional markets shaped by cash buyer activity

Cash buyers do not operate uniformly across the UK. Their presence is concentrated in specific regions where local economic conditions, demographics and property characteristics make cash purchases more feasible or desirable.

Cities across Northern England and Scotland have become primary targets for investors and landlords due to affordability and strong rental returns. Manchester, Liverpool, Leeds and Glasgow are frequently highlighted as areas where buyers can achieve excellent yields.

Cash buyers thrive in these markets because they are positioned to act quickly when high potential properties become available, often outpacing mortgage backed competitors.

Prime central London remains another territory dominated by cash buyers. Wealthy downsizers or international investors both contribute to strong demand for properties in prestigious postcodes. Mortgage backed buyers rarely compete at this level, and cash transactions often move rapidly in these markets.

There are also regions where cash buyers dominate due to structural or legal issues affecting the properties themselves. Areas with a high proportion of short leases, non standard construction homes or buildings requiring significant renovation attract cash buyers because many mortgage lenders are unwilling to lend on these properties.

Cash purchasers fill this gap and allow transactions to proceed smoothly in situations where mortgage buyers would struggle to secure finance.

These regional disparities show that the influence of cash buyers is far from uniform. Instead, it is shaped by local demand, affordability, investment potential and lifestyle trends. This variability must be considered when forecasting the future of the market.

What will shape cash buyer dominance?

To understand the future of cash buyers, we must consider the key forces shaping the UK property market in the years ahead.

Mortgage interest rates

One crucial factor is the trajectory of mortgage interest rates.

As rates stabilise and slowly decrease, more mortgage-backed buyers are expected to re-enter the market. This may reduce the gap between cash buyers and traditional buyers, but it is unlikely to remove the advantages cash buyers hold.

Mortgage lending will remain tightly regulated, and buyers will still face affordability checks, lender caution and potential delays. Cash buyers will continue to be preferred in competitive markets because they remove these uncertainties.

Economic stability

Property remains a dependable long-term investment during uncertain times, and this encourages both domestic and international investors to continue purchasing in cash. Even when the broader economy stabilises, property continues to be seen as a safe asset, meaning investors, especially those buying with cash, will remain active.

Demographics

Demographic changes are another significant factor. The UK’s ageing population means millions of homeowners will choose to downsize or release equity. These individuals often become cash buyers when purchasing their next property, contributing to sustained cash buyer activity for years to come.

We Buy Any House

We Buy Any House have made quick, guaranteed sales accessible, and their continued expansion indicates enduring demand for speed and certainty. As more homeowners prioritise straightforward transactions over achieving the absolute best price, the influence of professional cash buyers will continue to increase.

Housing Shortage

Finally, the UK’s long-standing housing shortage will play a central role. With new housing supply consistently falling short of demand, competition for available homes will remain intense. In such environments, sellers will continue to prefer cash buyers who can proceed quickly and without risk.

These combined factors make it clear that cash buyers will not disappear as mortgage conditions improve. Their role is supported not only by economic conditions but also by demographic trends and the structural limitations of the UK’s housing market.

The future market share of cash buyers

Cash buyers currently account for approximately one-third of all property purchases in the UK. Although this proportion fluctuates from year to year, it demonstrates their significant role in the market.

In some areas, such as auctions, retirement regions and investment hubs, cash purchases account for more than half of all transactions. These pockets highlight the powerful role cash buyers play and the likelihood that their influence will remain strong.

Looking ahead, it is possible that the proportion of cash buyers will dip slightly as mortgage rates fall and more mortgage-backed buyers gain confidence.

However, this decline is unlikely to be substantial. Cash buyers will remain dominant in several vital sectors, including auctions, properties requiring renovation, homes unsuitable for mortgages, high-yield investment areas and high-value markets such as London.

Fast-sale companies will continue to expand as more homeowners seek reliability, and cash will remain the strongest form of negotiation in a competitive environment. For these reasons, the future of the UK property market will continue to be heavily shaped by cash buyers, even if their overall proportion shifts slightly.

Conclusion

Cash buyers have permanently changed the dynamics of the UK property market.

Their ability to move quickly, provide certainty and bypass the complexities of mortgage lending has made them one of the most reliable and influential buyer groups. Although interest rates may fall and mortgage backed buyers will remain a central force. Their presence is supported by demographic shifts, investing patterns, the growth rate of fast sale companies and the continuing shortage of housing.

While the balance between mortgage buyers and cash buyers may fluctuate, the fundamental advantages of cash buyers ensure that they will continue to play a vital tole in shaping the housing market for many years to come. Whether the market is buoyant or subdued, cash buyers will remain an essential part of the property ecosystem.

If you are considering selling your home and want a fast, secure and stress free option, We Buy Any House can help. You can receive a free cash offer within 24 hours and complete the sale in as little as 7 days.

This service is ideal for homeowners facing uncertainty, dealing with challenging circumstances or simply wanting a quicker alternative to the open market.

You can start the process today and discover how effortless selling your home can be with a trusted house buyer.