How do I transfer ownership of an inherited property?

We Buy Any House

Like you, every property is unique, so we’ll just need a few details before we can make you an offer.

How do I transfer the ownership of an inherited property?

If you have recently inherited a house and have decided that you want to keep it, there are three steps you need to follow –

1. You will need to obtain ownership of the property legally

2. After this, you can transfer it into your name

3. Finally, you will need to register that you now own the property.

The Land Registry will transfer the property to your name.

A home, whether inherited or not, can be the source of both happy and sentimental memories. If your parents or guardians pass away and leave you the house, you may decide to keep it to create your own new memories in, or you may feel that transferring ownership of the property is a wiser option. Here we’ll explore how you can transfer the ownership of a property to someone else.

“I need to sell my house fast!” – Get a cash offer for your house today!

Before you can transfer ownership of an inherited property, you must obtain ownership of the house yourself. This involves various legal processes.

Obtaining ownership of the property

- Completing a probate application form: The form can be accessed here. The Probate also allows you to transfer or sell the property afterwards.

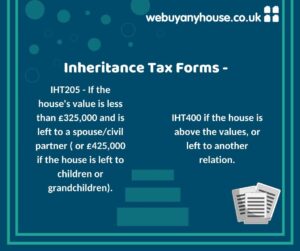

- Completing an Inheritance Tax form: The form you fill in depends on the house’s value and your relation to the deceased:

- Sending your application to the Probate Registry which must include various information, such as an official copy of the deceased’s death certificate.

- Swearing an oath: The promise that all the information you have given is true.

After this, you can start the transferral process.

The transferral process

- Fill in the AP1. This is an application to change the home owner on the register.

- Fill in the TR1. This form allows you to transfer a registered property. If you are unsure if the house is registered, you can check its status here.*

- You then need to fill in the ID1. This proves your identity when registering an application with the Land Registry. This form must be signed by a solicitor or licensed conveyance.

- Ensure you pay the right fee from the Fee calculator.

- Send the above to the Land Registry.

Homeownership will then be transferred within 5-6 weeks.

If you discover your house is not registered, you must follow the following steps to register it.

Registering a property

- Fill in the FR1, the application for first registration.

- If not already within the deeds, create a scale plan detailing where the land is. Table 1 from GOV.UK’s, ‘Guidance for preparing plans for Land Registry applications’ can aid you with the measurements needed.

- Then, depending on how you inherited the property, fill in either the AS1 or the TR1. You fill in the AS1 (‘whole of registered title assent’ form) if the house belonged to a sole owner and it’s been left to you in a will. You complete the TR1 (‘transfer of the whole of the registered title’ form) if you jointly owned the home with the deceased.

- Depending on the value of your property, find the correct registration fee.

- Send the above to the Land Registry.

1. The effect on the mortgage

You will need to speak to your mortgage lender before transferring ownership. If the new owners will be using the same lenders, then the mortgage may just carry over, though this varies depending on circumstance. There will likely be administration and valuation costs to cover.

2. Do you still want to live in the house?

Even after the transfer, you may want to continue living there. For example, if you were giving your child the house as an early inheritance gift, you could get a ‘lease of life’ – allowing you to stay in the property for the rest of your life. However, if your child decided they wanted to sell the house beforehand they would be able to do so, regardless of the lease.

Alternatively, if you pay them rent, the transferee may allow you to continue living there.

3.Tax

If you transfer the house, move out and live for another 7 years, there’s usually no inheritance tax to pay. If you die within 7 years, the home will be treated as a gift and is exempt from tax so long as its value is less than £325,000. If the house is worth more, your tax can range from 8-40% depending on the years between gift and death. See here for more details.

Capital Gains Tax applies when the transferred property is not the transferees’ only residency. For example, if your relative is not living in the home when you transfer it to them and it increases in value when they decide to sell it. There is an annual capital gains tax allowance of £11,100. For any increase above this:

- The gain is taxed at 18% for basic-rate taxpayers.

- The gain is taxed at 28% for higher-rate taxpayers.

The transferee may need to pay stamp duty land tax if there is a mortgage attached to the house. The rate varies depending on the house’s purchase price, from 0-15%. See here for the latest rates.

Other Risks

If you transfer your house to a relative who gets divorced, they may have to sell it as part of the settlement.

If the transferee is declared bankrupt, the house could be claimed by the bank or lender.

Frequently asked questions regarding transferring ownership of a property

- Can I transfer property to a family member?

Yes, you can. This is usually done to lower the amount of Inheritance Tax that will be due on the estate. You may want to transfer ownership of the property to one of your children. This can be done through a TR1 form and is considered as ‘gifting’ the property.

- How long does it take to transfer ownership of a property?

Typically, transferring ownership of a property can take four to six weeks. This involves the legal processes involved in the transfer.

- Can a deceased person own a property?

If the deceased owned a property with another person as beneficial joint tenants, their share will pass to the surviving owner. Joint tenants mean the property does not form part of the deceased’s estate.

Transferring an inherited house is a decision not to be taken lightly, as there are clearly many things to consider, and the processes involved can be long and arduous. Consulting a solicitor is advised as this post provides only a general guide, and everybody’s situation is different.

We buy any home in as little as 3 days, or timescales to suit you. Head to our website for more information.

Back to all articlesYou may also be interested in

-

Moving House Checklist: Your Ultimate Guide for 2024

Moving to a new home can be exciting, but it also comes with its own set of…

-

09, September, 2024Valuing an Inherited Property

A Friendly Guide to Inheriting and Valuing Property Inheriting a property can be a mix of emotions.…

-

09, September, 2024Selling an Inherited Property in Poor Condition

Inheriting a house can feel like a blessing, but when that property isn’t in the best shape,…